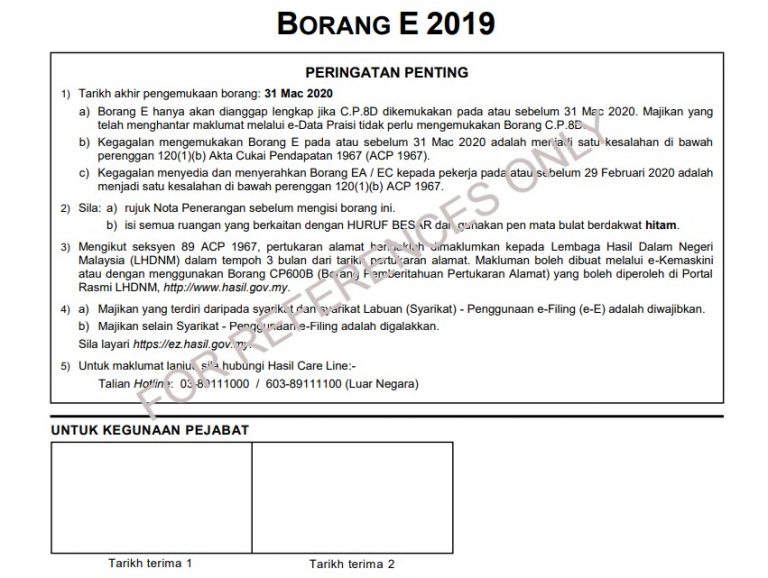

- Tax Declaration needs to be done within 7 months after youve closed your books. 22102020 As a sole proprietor you have to take care of marketing finances strategy leadership and basically every other responsibility.

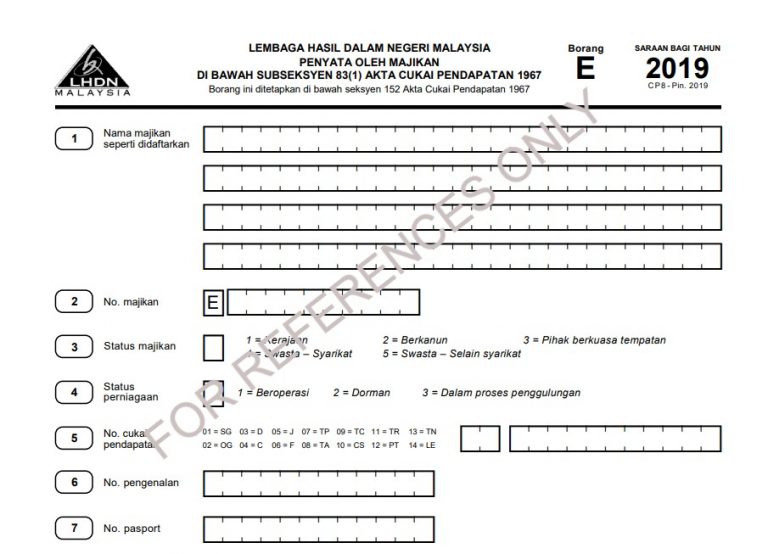

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Identity card name cant be used as business name.

Sole proprietor borang e. Unlimited liabilitywhich can extend to personal assets of the sole proprietor. State whether Sole Proprietor Precedent Partner or Principal Officer. E-Permohonan Pindaan BE adalah permohonan pindaan atas kesilapan atau khilaf bagi Borang Nyata Cukai Pendapatan yang telah dikemukakan secara e-Filing atau m-Filing dalam tempoh Semakan Pengesahan Semakan semula pengesahan penerimaan borang yang telah dihantar secara e.

The following information are required to fill up the Borang E. MAKLUMAT MAJIKAN EMPLOYERS PARTICULARS B1 Nama pengarah Pemilik tunggal Pekongsi utama Individu yang diberi kuasa Name of director Sole proprietor Precedent partner individual with authority B2 Alamat Kediaman Residential Address Poskod Postcode Bandar Town Negeri State. CC1DOGFT No.

- Annual Declaration needs to be done within 3 months of the end of your accounting period. Company Secretary Compliance officer. They are not classified as partners in the enterprise or an independent contractor enabling the business to retain its sole proprietorship status and not be required to submit a partnership income tax return.

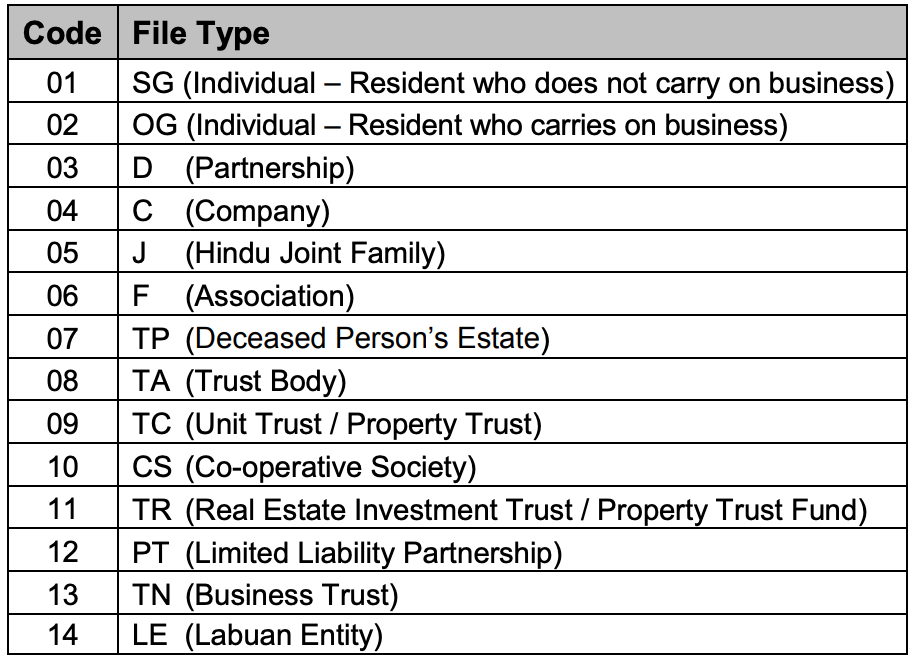

Examples of a business entity include an LLC partnership and corporation. Videos you watch may be added to the TVs watch history and influence TV recommendations. ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2020 in accordance with subsection 83 1B of the Income Tax Act ITA 1967.

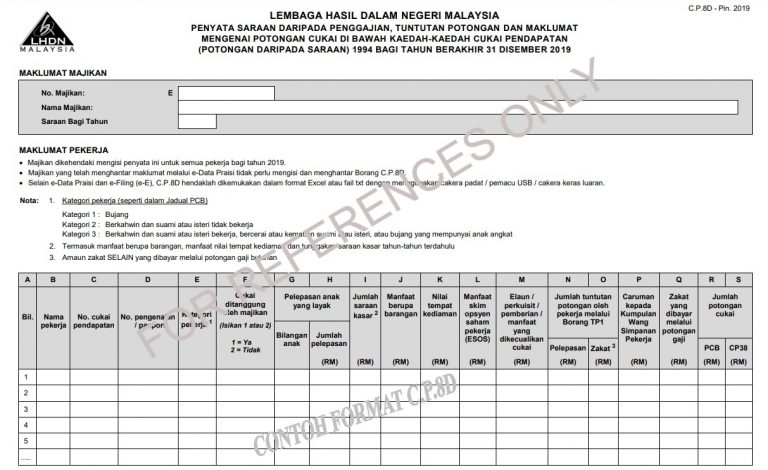

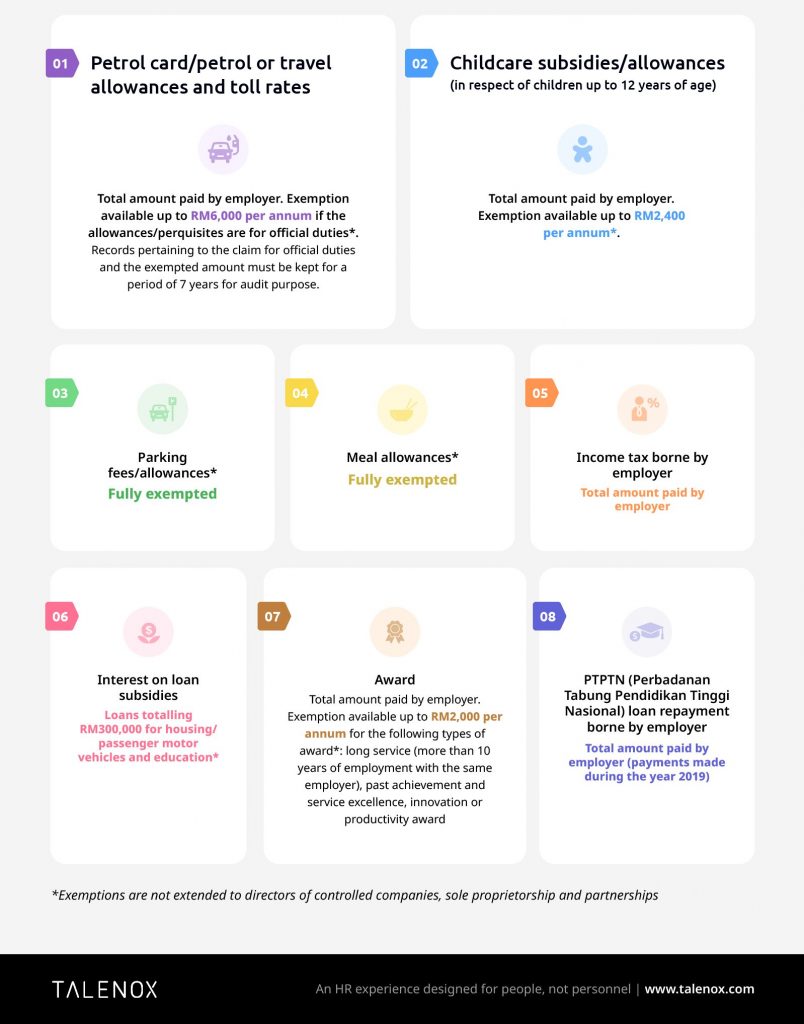

Details for ALL employees remuneration matters to be included in the CP8D. Guideline for piam registration a new applicants sole proprietor partnership limited co 1 piam application form duly signed x 2 borang 24 49 x 3 borang 9 13 change of name x 4 borang a b d x 5 photocopy i c of corporate nominee x 6 mii certificate of corporate nominee x 7 piam fee cash or cheque x 8 statutory declaration by corporate nominee x. Failure to submit Form E are liable to a fine of not less than RM 200 and not more than RM 20000 or to imprisonment for a term not exceeding 6 months or to both under the Income Tax Act Section 1201b.

A sole proprietorship is the simplest and most common structure chosen to start a business. This could create burnout very quickly. Large group of companies with many subsidiaries as soon as these businesses are employers must submit form E.

Now that we understand how sole proprietorships work lets learn how a sole proprietor would go about paying themselves. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. It is an unincorporated business owned and run by one individual with no distinction between the business and you the owner.

A14 e-Mel e-Mail BAHAGIAN B. Even the company is not employing any employee one still need to file in the Form E. On and before 3042021.

Even a dormant company must submit Form E. Example of Form E Borang E The Form E consist of the companys employer particulars and details for ALL employee renumerations to be included in CPP8D. Minimum 1 and maximum 50 in private company.

Basically a sole proprietor is the default kind of. If playback doesnt begin shortly try restarting your device. 05042020 All employer are required to furnish the Form E return by 31 March every year be it sole proprietor partnership sdn bhd or bhd.

PART B. According to the Inland Revenue Board of Malaysia LHDN a business which earn business income whether it is a. You are entitled to all profits and are responsible for all your businesss debts losses and liabilities.

Business wholly owned by a single individual using personal name as per his her identity card or trade name. 08072017 - Employers Return Form Borang E needs to be submitted by 31 March of every year. How Do I Pay Myself as a Sole Proprietor.

A permitted exception to the sole proprietor single owner stipulation is made by the Internal Revenue Service IRS permitting the spouse of a sole proprietor to work for the business. Business owned by two or more persons but not exceeding 20 persons. A sole proprietor is a one-person business that isnt registered as a business entity with a state.

Sole proprietor partnership a private limited company or a. 05112020 What Is a Sole Proprietor.

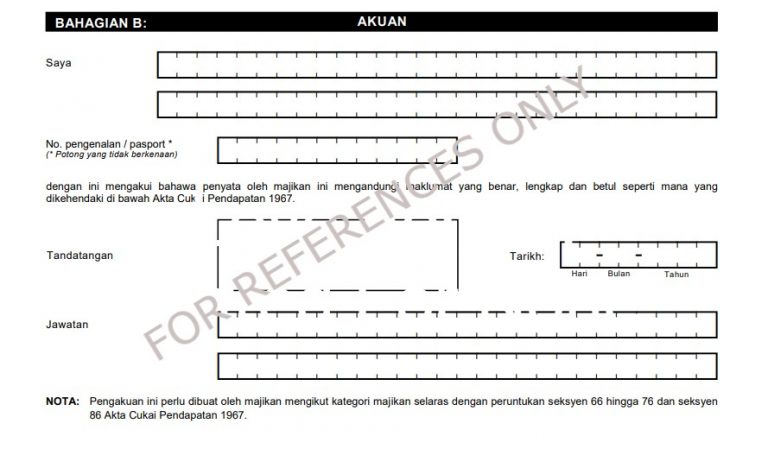

How to start a business. 2 to 20 partnersExcept for partnerships for professional practice with no maximum limit Sole proprietor only. Tandatangan Majikan Signature of Employer ALAMAT ADDRESS No.

Minimum 2 and no maximum limit.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Malaysia Tax Guide What Is And How To Submit Borang E Form E

2019 2021 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Malaysia Tax Guide What Is And How To Submit Borang E Form E